If you’ve been considering a solar project, you might want to get it done sooner rather than later. That’s because the Federal Solar Tax Credit (also known as the Investment Tax Credit, or ITC) is scheduled to step down from 30% to zero over the next three years.

Here are the TOP FIVE things you need to know before your federal tax incentive sun sets:

The solar ITC can help you significantly offset installation costs.

The solar ITC is a 30% tax incentive on your gross solar system cost and the single largest incentive currently available. This came about as part of the Energy Policy Act in 2005 and the federal government has already extended the incentive expiration date twice before. The most recent extension in 2016 added a “step down” schedule that gradually phases out the credit by 2022.

As an example, on a solar system that costs $10,000 to install, you would receive $3,000 as a credit on your gross income tax, so the net cost would only be $7,000.

Is there any catch to getting the solar ITC tax credit?

You can only qualify for the solar ITC if you own your solar system or are financing it through a solar loan. You also need to owe income tax. For example, if your 30% tax credit is $5,000, but you only owe $3,000, you can rollover the remaining $2,000 to next year’s income taxes.

You also need to fully install and pay for your solar system in 2019 to ensure that you receive your full 30% ITC tax credit.

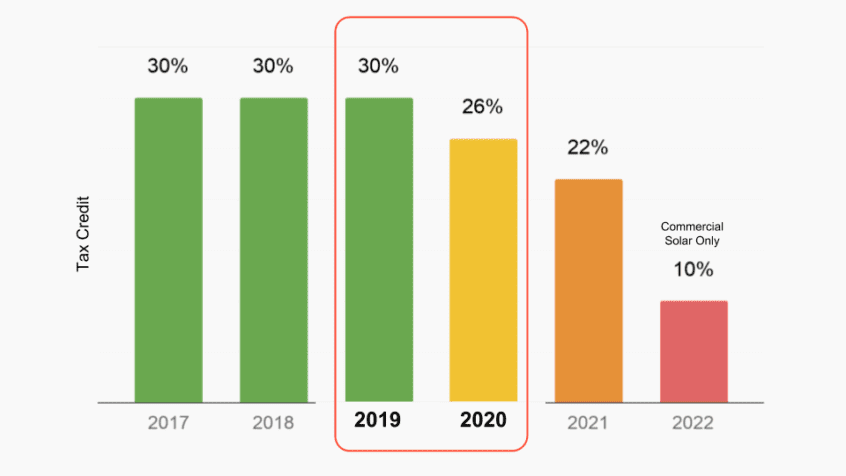

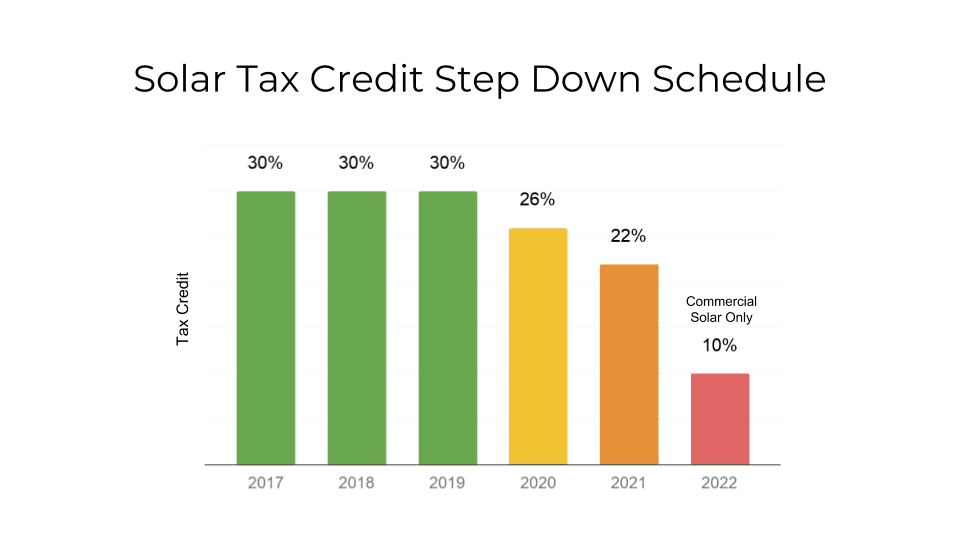

What’s the solar ITC tax credit step down schedule?

2019 is the last year for the full 30% solar ITC tax credit! Starting in 2020, the credit drops to 26%, then 22% in 2021, and then 0% by 2022*. The difference in savings from 30% to 26% is significant and could be as much as several thousand dollars.

Here’s the full solar ITC step down schedule:

The federal tax credit will soon be under 30%

* From 2022 on, a 10% tax credit will remain for commercial and industrial projects only.

4. What’s the likelihood of the solar ITC incentive being extended again?

While it’s unlikely that the federal government will extend the full 30% incentive in the future, it is possible that they will extend the step-down schedule. Plus, New Mexico will likely follow states like Nevada, Colorado and California that have enacted increased and stricter renewable energy requirements, so they will likely offer increased state tax benefits to help ease the burden.

5. How do I claim the solar ITC incentive?

To claim your solar project federal tax credit when filing taxes, make sure to complete IRS Form 5695 for residential or IRS Form 3468 for commercial. Always consult a tax professional for more personalized guidance.

Final Tips if you are considering going solar:

- It is in your best interest to complete a solar project for your home or business by the end of 2019 in order to take advantage of maximum cost savings.

- As the end of 2019 approaches, more and more home and business-owners will be rushing to complete their solar projects. Start your project ASAP so you can make sure it gets done right and on-time.

- Shop around, do your research and seek out testimonials when choosing an installation company, but remember: over-analysis often results in paralysis. Don’t waste too much time before it’s too late!

- At SunState Solar, we cut through all the noise and too-good-to-be-true claims to make going solar simple and easy. Schedule your free consultation today!